Looking for Lower-High in USD/JPY as Pair Pushes Into Resistance

Talking Points:

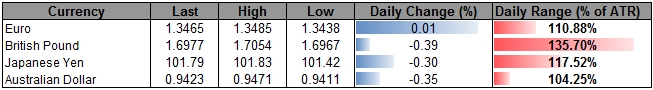

- GBP/USD Searches for Support Ahead of U.K. 2Q Gross Domestic Product (GDP)

- USD/JPY Comes Up Against Resistance Ahead of Japan’s Consumer Price Index (CPI)

- USDOLLAR Turns Around Ahead of 10,470 Pivot as New Home Sales Disappoint

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10460.18 |

10465.74 |

10435.82 |

0.24 |

115.80% |

GBP/USD:

- Weakens to a fresh monthly low as U.K. Retail Sales increases 0.1% versus 0.3% expected; 2Q GDP expected to expand another 0.8%.

- May need strong growth figures for GBP/USD to retain the bullish trend from earlier this year; 1.6940-60 remains the key region of interest as it stands above trendline support.

- DailyFX Speculative Sentiment Index (SSI) continues to narrow but remains in negative territory as ratio current stands at -1.49.

USD/JPY:

- Will continue to look for resistance around former support region, which comes in at 101.80-102.00.

- Remains at risk for a further decline as the USD/JPY continues to carve series of lower-highs in July.

- Japan’s Consumer Price Index (CPI) is expected to narrow to an annualized pace of 3.5% from 3.7% in June, but it looks as though the Bank of Japan (BoJ) will retain its current approach for monetary policy as the central bank remains upbeat on the real econmy.

For more updates, sign up for David's e-mail distribution list.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Surprise PMIs Offer EUR/JPY, EUR/USD ST Reversal Opportunities

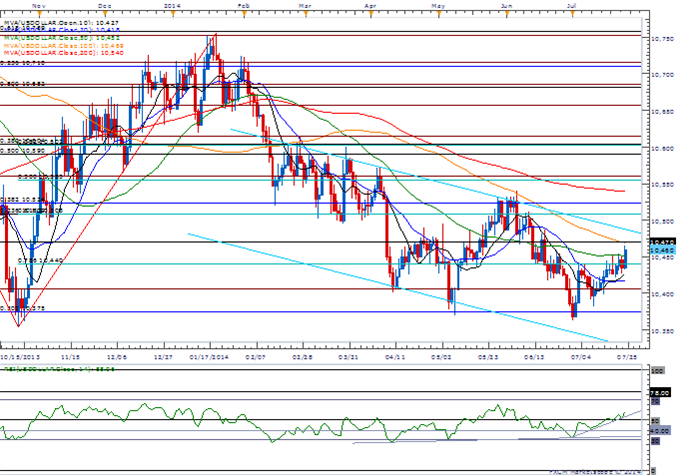

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

USDOLLAR(Ticker: USDollar):

- Dow Jones-FXCM U.S. Dollar Index correction stalls ahead of 10,470 as U.S. New Home Sales slip 8.1% in June amid forecasts for a 5.8% decline.

- Remains at risk of carving a lower-high ahead of the Fed’s July 30 meeting as Chair Janet Yellen retains a dovish tone for monetary policy; will continue to favor the downward trending channel from earlier this year.

- Will continue to look for a bearish break in the Relative Strength Index (RSI) to have greater conviction/confirmation of a lower-high.

- Interim Resistance: 10,508 (61.8% retracement) to 10,524 (38.2% retracement)

- Interim Support: 10,354 (Oct. low) to 10,375 (50.0& retracement)

|

Release |

GMT |

Expected |

Actual |

|

Initial Jobless Claims (JUL 19) |

12:30 |

307K |

284K |

|

Continuing Claims (JUL 12) |

12:30 |

2510K |

2500K |

|

Markit Purchasing Manager Index Manufacturing (JUL P) |

13:45 |

57.5 |

56.3 |

|

New Home Sales (JUN) |

14:00 |

475K |

406K |

|

New Home Sales (MoM) (JUN) |

14:00 |

-5.8% |

-8.1% |

|

Kansas City Fed Manufacturing Activity (JUL) |

15:00 |

6 |

9 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia