Natural Gas Plunges Ahead Of Storage Data, Pressure On Crude Oil Eases

Talking Points

- Crude Could Consolidate As Oil-Impacting News Flow Slows

- Gold May Remain Elevated As Eastern European Tensions Linger

- Natural Gas Vulnerable To Upside Surprise From Storage Data

CrudeOil may consolidate as the commodity awaits fresh fundamental cues following a mixed US inventories report. Also in the energy space; natural gas remains vulnerable if upcoming storage data surprises to the upside following the plunge in prices on Wednesday. Meanwhile, gold and silver could remain elevated with a lack of major fundamental data due from the US over the session ahead.

Slowing News Flow Could Offer Crude A Consolidation

The Brent crude benchmark recovered lost ground during Wednesday’s session with the commodity posting its largest daily percentage gain since July (+1.22 percent). Easing OPEC supply disruption fears had likely led the commodity lower over the past several weeks. With the related risk premium having now largely evaporated, crude may be afforded a consolidation at worst and corrective bounce at best. Yet the potential for a more sustained advance remains questionable in the absence of the necessary fundamental drive.

Gold May Remain Elevated As Eastern European Tensions Linger

Gold and silver’s sideways drift has persisted in recent trading with volatility (measured by the 14 day ATR) hitting its lowest since June today. Ongoing turmoil surrounding Ukraine and the Middle East continues to offer the alternative assets a source of haven demand. However, as witnessed in recent months the precious metals are prone to corrections on a de-escalation of geopolitical tensions.

An absence of major US economic data on the docket over the session ahead could leave gold with little guidance from the US dollar side of the equation.

Natural Gas Plunges Ahead Of Storage Figures

Upcoming storage injections data for natural gas puts the commodity in a precarious position following a dramatic decline for prices on Wednesday (-3.6 percent). The correction likely reflected repositioning from traders ahead of the fundamental event risk as well as some hesitation close to the psychologically-significant $4.00 barrier.

Three consecutive weeks of weaker-than-anticipated storage change figures likely renewed supply constraint fears, which in turn aided a recovery for the commodity. However, if incoming injections surprise to the upside natural gas could encounter further selling pressure. Times and expectations for the release are available on the economic calendar here.

CRUDE OIL TECHNICAL ANALYSIS

Downside risks remain for crude given the short-term downtrend remains in force (signaled by the 20 SMA and trendline). The press past the 97.50 barrier casts the spotlight on the recent lows near 96.30. Clearance of the 98.90 hurdle and descending trendline would be required to invalidate a bearish technical bias.

Crude Oil: Targeting Recent Lows With Downtrend Intact

Daily Chart - Created Using FXCM Marketscope 2.0

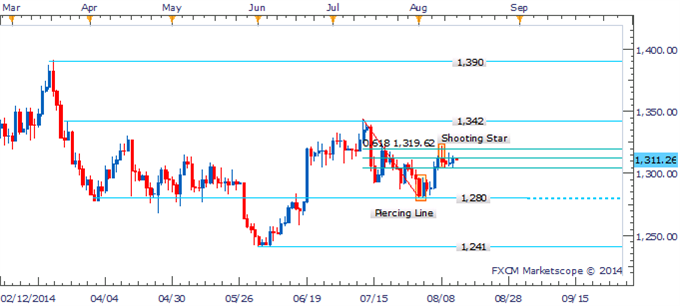

GOLD TECHNICAL ANALYSIS

Choppy price action continues to plague gold after a failed attempt to breach the 1,319 ceiling. A pullback from the 61.8% Fib at 1,319 has yielded a Shooting Star formation. However, the reversal signal has not seen the required follow-through to warn of a more significant correction at this stage. A break below the 1,300 floor would set the stage for an extended decline towards 1,280.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Awaiting Break Through Congestion Zone To Offer Directional Bias

Daily Chart - Created Using FXCM Marketscope 2.0

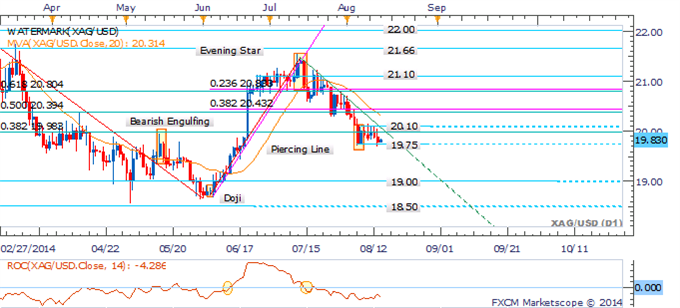

SILVER TECHNICAL ANALYSIS

Silver’s sideways drift over the past several sessions may give way to a break lower with indications of a short-term downtrend remaining intact. A push past what is likely weak buying support at 19.75 would pave the way for a descent to the 19.00 floor. A daily close above the descending trendline and 20.10 ceiling would be required to shift the bias to the upside.

Silver: May Resume Its Descent With Bearish Signals Intact

Daily Chart - Created Using FXCM Marketscope 2.0

COPPER TECHNICAL ANALYSIS

Copper has completed a double top formation with a break of the baseline suggesting the potential for further weakness. A more significant daily close below the 3.117 mark (61.8% Fib) would set the stage for a descent to 3.01. A climb back above the 3.19 hurdle would be required to negate a bearish technical bias.

Copper: Double Top Formation Casts Immediate Risk Lower

Daily Chart - Created Using FXCM Marketscope 2.0

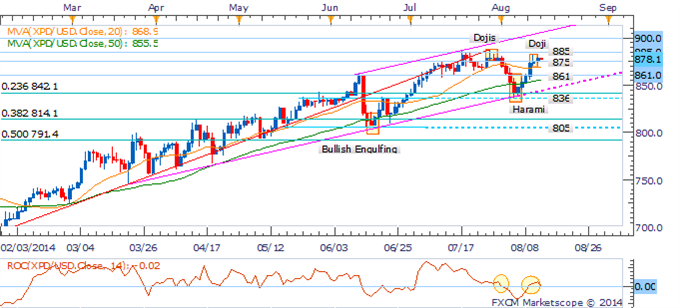

PALLADIUM TECHNICAL ANALYSIS

Palladium continues to demonstrate resilience with the commodity resuming its upward ascent in recent trading. An absence of bearish reversal candlestick patterns and a climb into positive territory for the ROC indicator signals the potential for further gains. Clearance of the 875 barrier would re-open the 2014 highs near 885.

Palladium: Awaiting Break of Nearby Resistance As Uptrend Resumes

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum is set for a make-or-break moment on a retest of its ascending trend channel on the daily. A push below the barrier alongside the Evening Star formation would warn of a correction to 1,443. However, given the medium-term upward trajectory of the commodity room should be allowed for a corrective bounce.

Platinum: Facing Make-Or-Break Moment On Retest Of Ascending Trend Channel

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia