Natural Gas Probes Above $4.00, Gold Vulnerable As Haven Demand Ebbs

Talking Points

- Crude Oil Cautiously Recovers As Iraqi Turmoil Continues

- Natural Gas Probes Above $4.00 On Storage Data Speculation

- Silver Downside Risks Remain While Sub The $20.10 Ceiling

Crude oil is edging cautiously higher during the Asian session as traders assess the potential for supply disruptions in Iraq. Also in the energies space; natural gas continues to recover ground with a series of weaker-than-anticipated storage readings over recent weeks helping to bolster prices. Meanwhile, gold and silver remain vulnerable to fading geopolitical concerns and an abating of safe-haven demand for the precious metals.

WTI Continues Cautious Recovery

The commencement of US airstrikes in Iraq over the weekend holds mixed implications for the Brent and WTI benchmarks. An escalation in the ongoing unrest that has gripped the OPEC producer could see crude prices remain elevated in the near-term. However, ultimately an increased US military presence would raise the probability of a timelier end to the conflict. This in turn would raise the chances of oil supplies flowing normally, which could see any related risk premium for crude quickly evaporate.

Looking past supply considerations in the Middle East; WTI’s recent recovery also has the markings of a a corrective bounce at this stage. The commodity has plunged by close to 9 percent since its June highs above $107 a barrel, which may in turn be prompting some profit-taking on short positions.

Bulls Return To The Natural Gas Market

Natural gas prices have soared by more than 1 percent in Asian trading today with the commodity probing above the psychologically-significant $4.00 handle. A series of weaker-than-anticipated storage builds have helped the energy commodity recover by close to 7 percent since its July lows.

If incoming storage data continues to print below consensus forecasts natural gas could be afforded further gains. Newswires have pointed to milder weather conditions in the US as a reasoning behind some the recent soft builds. Additional support for the commodity may stem from fears over supply disruptions from Russia, the world’s largest energy exporter.

Gold, Silver At Risk On Fading Geopolitical Concerns

A light economic docket over the session ahead is likely to afford the precious metals little guidance from their pricing currency, the US Dollar. This may leave gold and silver vulnerable to further weakness on ebbing safe-haven demand as traders look past heightened geopolitical concerns. However, regional conflicts are inherently difficult to predict and while embers of unrest remain glowing, gold may retain some of its shine.

CRUDE OIL TECHNICAL ANALYSIS

Downside risks remain for crude given the short-term downtrend remains in force (signaled by the 20 SMA). However, the climb back over the 97.50 hurdle suggests some potential for a corrective bounce over the next few sessions. A retest of the 98.90 mark (23.6% Fib) would offer a new opportunity for short positions, while a break higher would invalidate a bearish technical bias.

Crude Oil: Corrective Bounce To Offer New Short Entries

Daily Chart - Created Using FXCM Marketscope 2.0

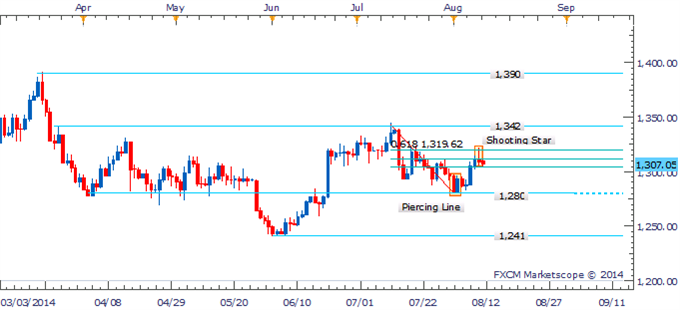

GOLD TECHNICAL ANALYSIS

Choppy price action continues to plague gold after a failed attempt to breach the 1,319 ceiling. A pullback from the 61.8% Fib at 1,319 has yielded a Shooting Star formation. If confirmed by a successive down period the bearish reversal pattern could be the precursor to a correction. A push past the 1,300 floor would set the stage for an extended decline towards 1,280.

The DailyFX SpeculativeSentimentIndex suggests a bullish bias for gold based on trader positioning.

Gold: Awaiting Break Through Congestion Zone To Offer Directional Bias

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver’s sideways drift over the past several sessions may give way to a break lower with indications of a short-term downtrend remaining intact. A push past what is likely weak buying support at 19.75 would pave the way for a descent to the 19.00 floor. A daily close above the descending trendline and 20.10 upside barrier would be required to invalidate a bearish technical bias.

Silver: May Resume Its Descent With Bearish Signals Intact

Daily Chart - Created Using FXCM Marketscope 2.0

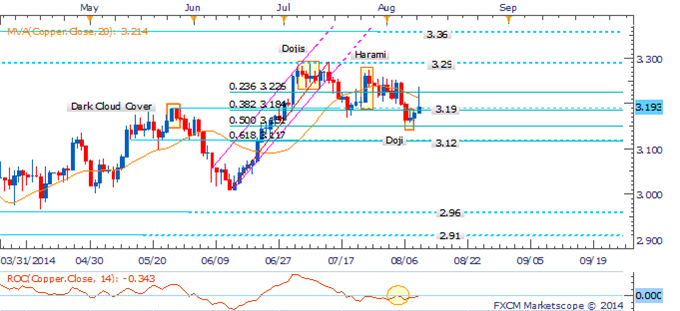

COPPER TECHNICAL ANALYSIS

Copper has completed a double top formation with a break of the baseline suggesting the potential for further weakness. This puts the spotlight on the nearby 3.15 mark (50% Fib), which if broken would set the stage for a descent to 3.12. A daily close back above the 3.19 hurdle would be required to negate a bearish technical bias.

Copper: Double Top Formation Casts Immediate Risk Lower

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

Palladium’s break of its long-held ascending trend channel casts a bearish light on the commodity. The retest of the trendline will help to confirm whether there is the potential for a more significant correction. A pullback would likely be met by buying support near the 836 floor.

Palladium: Retest of Trendline To Confirm Breakout

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum has failed to clear the nearby 1,486 barrier with a pullback leaving the commodity to retest its descending trendline on the daily. A bounce would confirm the initial break higher and set the stage for a run on 1,502.

Platinum: Retest Of Descending To Confirm Upside Break

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia