The Dollar Meltdown and Rebound – What Did the Fed Do?

Talking Points:

- EURUSD trades back under 1.0700 after seeing 1.1000 yesterday.

- USDCAD finds triangle support, trades back to daily 8-EMA.

- See the March forex seasonality report for trends in the QE-era.

Yesterday produced the largest single-day rally in EURUSD since October 27, 2011, at the height of the Euro-Zone crisis. Subsequently, that also marked the turning point in the EURUSD uptrend, paving way for a selloff that lasted for the next nine-months. This time is different, however, with the Fed at the epicenter rather than the ECB. What might have the Fed done to provoke such a violent move in the greenback?

Adjusting the Policy Point of View

The most obvious and expected development from the FOMC meeting was the removal of the word "patience" from the policy statement. Everyone knew this was coming, and it seemed that this was the Fed backtracking on an earlier mistake - attempting to equate language with a specific timeline for a rate hike. The removal of the word "patience" now puts more focus on incoming data, as Fed Chair Janet Yellen said...

The US Dollar's Strength Reflects that of the US Economy

This reason is one of the prime culprits for the US Dollar meltdown. By tying the greenback to the state of the economy, the Fed was near-guaranteeing that the US Dollar would selloff. Why? US economic data has been terrible of recent, with gauges of economic data momentum showing their weakest start to the year at any point over the past five years. We explored this disconnect between markets and the economy on Monday.

Changing the Goalposts

The US Dollar had been on a tear since the March 6 release of the February US labor market report. In part, this was due to the belief that the economy was reaching the Fed's definition of "full employment," with the central tendency of the unemployment rate in the 5.2%-5.5% range. This was mistaken. Yesterday, the Fed announced that its central tendency of maximum employment had shifted to 5.0%-5.2%. If the central tendency was a threshold by which market participants could look to for when the Fed would raise rates, the Fed just pushed it further away. The labor market, despite its recent strength, needs to improve even further before the Fed will consider raising rates now.

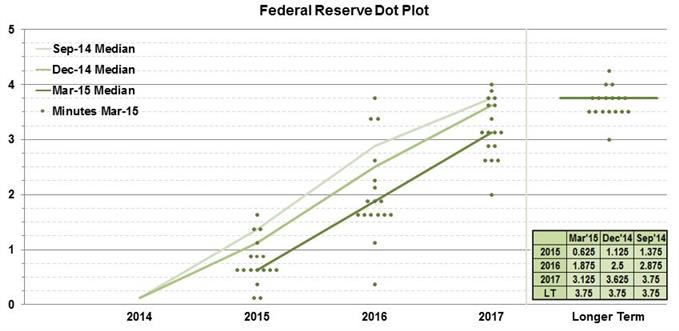

The most recent economic projections conveyed a more dovish Fed, at least from a consensus perspective. The aggregate policymakers' interest rate forecasts for the next several years - collectively known as the 'dot plot' - have shifted much lower from December 2014 to March 2015:

If you look in the bottom right, you can see the numerical representation of the dots. The median expectation of the Fed funds rate for the end of 2015 was sliced to 0.625% from 1.125% as indicated in the December economic projections. Essentially, two rate hikes have been taken off the table this year after the economy's weak start in Q1.

What is the Market Pricing in Now?

Fed funds futures contracts can be used to price the likelihood of a rate change, and traders have spoken quite loudly. On Tuesday, traders were pricing in a 81.4% chance of the main rate being at 0.25% or lower in June, and a 55% chance of the main rate being at 0.50% or higher in September. Today, there is now an 88% chance of the Fed holding rates through June and only a 42.2% chance of a rate hike in September. Traders are now pricing in December 2015 (66.6%) as the most likely meeting when the Fed raises its main interest rate.

See the above video for technical considerations in EURUSD, GBPUSD, AUDUSD, and USDCAD.

Read more: Pre-FOMC Trade Setups in USD-pairs

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

original source

Indonesia

Indonesia