USD/CHF Overlooks Swiss Trade Balance Data; Focus Turns To US CPI

Talking Point:

- CHF Trade Balance (Swiss Franc) (Jun): 1.38B Actual Vs 2.78B Estimated; 2.85B Prior.

- USD/CHF remains relatively muted after the release of Switzerland’s Trade Balance data.

- Focus Will Turn to The June US CPI Figures As A Potential Volatility Spark For USD/CHF.

Want to trade with proprietary strategies developed by FXCM? Find out how here.

Switzerland Trade Balance figure for the month of June registered at 1.38B Swiss Franc (SF) versus the 2.85B SF in the prior month. The data recapitulates the difference between the total value of Swiss exports and imports and came in short of market expectations of 2.78B SF. The positive Trade Balance indicates a trade surplus, which translates into greater demand for the currency and upward pressure on the value of the Franc.

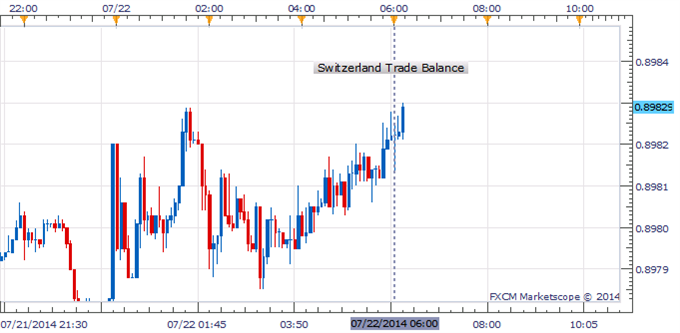

Ahead of the data, USD/CHF grinded higher to trade at 0.8982. Straight after the release the reaction of Swiss Franc against the Greenback was relatively muted. Looking ahead, the US Dollar may find volatility in the lead up to the June US Consumer Price Index figures, which will be released later today at 12:30 GMT. The consensus is for the annual price-growth to maintain its 2.1 percent reading while the core remains at 2.0 percent. If June’s inflation data outshines expectations, this may cause an upside surprise as it may inspire speculation for a sooner-than-expected interest rate hike by the Fed says DailyFX Currency Strategist Ilya Spivak.

From a technical panorama, Ilya Spivak mentions near-term support to rest at 0.8934 (23.6 Fib Exp.) and resistance at 0.8983-94 (38.2% Fib Exp.). He remains flat for now as prices remain too close to the resistance level and there is an absence of a defined bearish signal.

USD/CHF 5 Minute Chart

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

New to FX? START HERE!

Edward Hyon, DailyFX Research Team

Keep up to date on event risk with DailyFX Calendar

original source

Indonesia

Indonesia