USDJPY Surge Likely Short-Lived as Pairs Stick to Tight Ranges

USDJPY Surge Likely Short-Lived as Pairs Stick to Tight Ranges

Fundamental Forecast for Japanese Yen: Neutral

US Dollar consolidates in familiar territory versus the Japanese Yen, breaks following NFPs data

Volume profile suggests USDJPY could extend higher

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

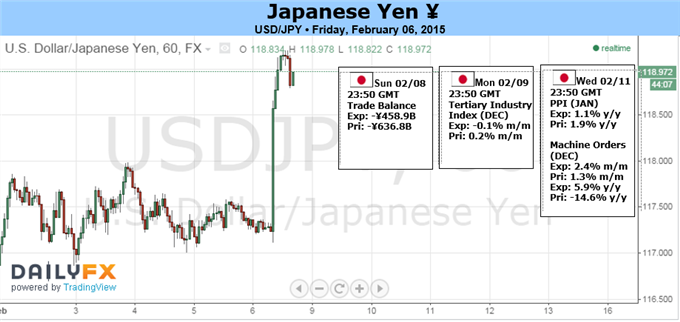

The Japanese Yen finished the week noticeably lower versus all major counterpart and pushed the US Dollar/JPY exchange rate through key resistance. Could this be the start of a larger USDJPY breakout?

The interest rate-sensitive JPY was among the biggest losers as the US Dollar surged on a strong US Nonfarm Payrolls report. Yet a noteworthy drop in FX volatility prices suggests that relatively few expect similarly large moves ahead. Indeed, limited economic event risk ahead may keep US Dollar pairs in tight trading ranges—limiting our enthusiasm on fresh USDJPY-long positions.

Any substantial surprises out of upcoming Japan Trade Balance results, Industrial survey data, or Producer Price Index inflation numbers could force a Yen reaction. Yet traders have proven relatively indifferent to Japanese economic data, and sharp post-event moves seem relatively unlikely.

A strong correlation between the USDJPY and US Treasury Yields will thus keep us mostly focused on US economic data. To that end we’ll watch the upcoming US Advance Retail Sales report for potentially meaningful reactions from yields and the USDJPY.

It thus far looks as though it will be a quiet week for the Japanese Yen. And despite its substantial post-NFPs rally, the USDJPY remains in a broad consolidative range dating back to December highs. Only a break of significant resistance near January’s peak of ¥121 and eventually 8-year highs near ¥122 would change that.

We subsequently remain somewhat bearish the USDJPY (bullish the Japanese Yen) through the foreseeable future. - DR

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com David specializes in automated trading strategies. Find out more about our automated sentiment-based strategies on DailyFX PLUS.

Contact and follow David via Twitter: https://twitter.com/DRodriguezFX

original source

Indonesia

Indonesia