USD/JPY Trading Below Resistance After Optimistic Fed Stress Test

Talking Points:

- Fed says large banks are better positioned for crisis

- 29 out of 30 banks meet capital targets

- USD/JPY continues to trade below resistance

Want to trade with proprietary strategies developed by FXCM? Find out how here.

The Federal Reserve announced the results of a stress test today after the close of US markets, saying that 29 of the 30 banking institutions met or topped its capital targets. The Fed said that the largest banking institutions are better positioned for a financial crisis than 5 years ago and have improved their capital positions.

The improved position of the major banks paints a better picture of the economy and financial institutions since the crisis in 2008. A majority of Fed members expect the FOMC to raise the interest rate and end quantitative easing by the end of 2015, according to yesterday’s statement, and today’s stress test results may further allow the Fed to tighten policy without worrying about the impact on lending institutions.

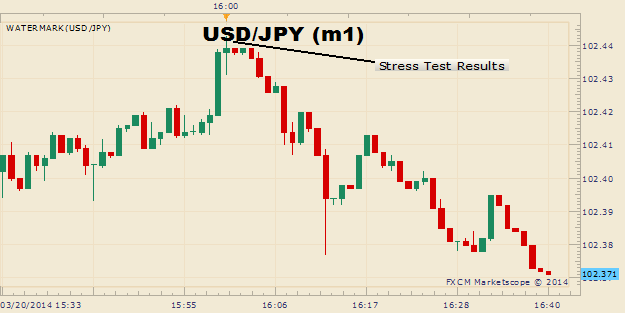

USD/JPY 1-Minute: March 20, 2014

The US Dollar continued to trade against the Japanese Yen right below resistance at 102.70 after the release, and David De Ferranti notes that a break of that level could allow USD/JPY to post further gains up to 103.50.

Chart created by Benjamin Spier using Marketscope 2.0. Add DailyFX Support/Resistance to your charts at FXCM Apps.

-- Written by Benjamin Spier, DailyFX Research. Feedback can be sent to [email protected] .

original source

Indonesia

Indonesia