USDOLLAR Outlook Mired by Downside Inflation Risk- CPI in Focus

Talking Points:

- USDOLLAR Fails to Break Monthly Opening Range as FOMC Highlights Downside Risk for Inflation.

- USD/JPY Extends Advance on Dovish BoJ- RSI Resistance in Focus.

- GBP/USD Rebounds from Fresh Monthly Low as BoE Sees Greater Risk for Inflation.

For more updates, sign up for David's e-mail distribution list.

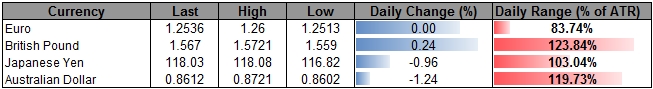

USDOLLAR(Ticker: USDollar):

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11316.23 |

11320.06 |

11282.39 |

0.32 |

60.45% |

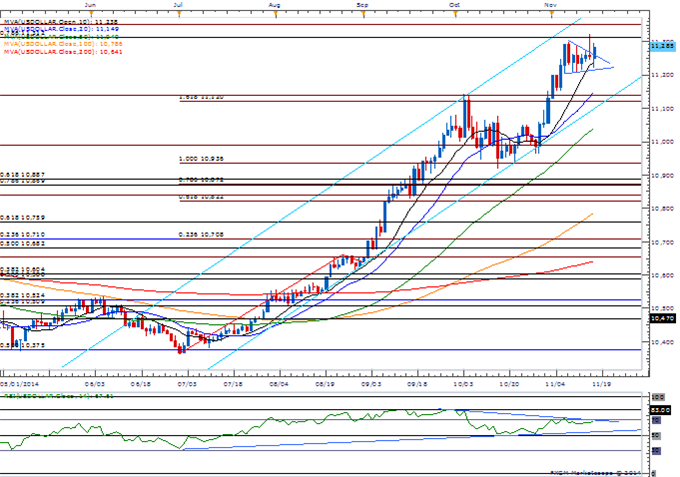

Chart - Created Using FXCM Marketscope 2.0

- The Dow Jones-FXCM U.S. Dollar Index may hold the monthly opening range as the Federal Open Market Committee (FOMC) highlights the downside risk for inflation; still waiting for a bullish break in RSI for conviction/confirmation for another leg higher.

- With the U.S. Consumer Price Index (CPI) expected to slow to an annualized 1.6% in October, a further downtick in the headline reading may generate a larger pullback in USDOLLAR as the Fed remains in no rush to normalize monetary policy.

- Lack of momentum to close above 11,312 (78.6% retracement) and 11,351 (78.6% expansion) raises the risk for a larger correction; will watch former resistance around 11,120 (161.8% expansion) to 11,138 (61.8% expansion) for new support.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Housing Starts (OCT) |

13:30 |

1025K |

1009K |

|

Housing Starts (MoM) (OCT) |

13:30 |

0.8% |

-2.8K |

|

Building Permits (OCT) |

13:30 |

1040K |

1080K |

|

Building Permits (MoM) (OCT) |

13:30 |

0.9% |

4.8% |

|

Federal Open Market Committee Meeting Minutes |

19:00 |

-- |

-- |

Click Here for the DailyFX Calendar

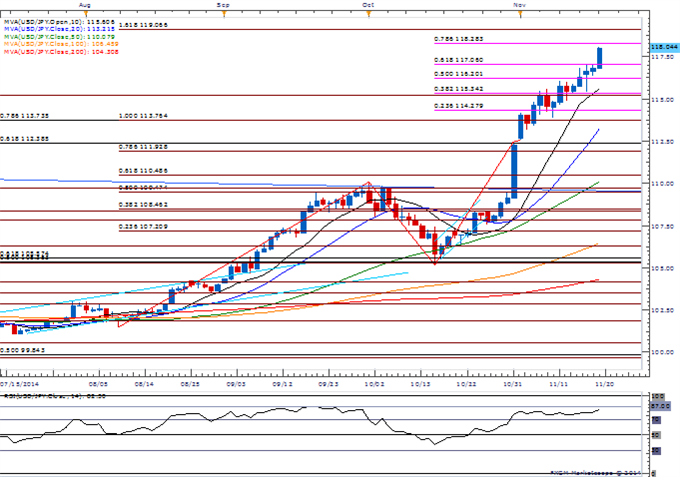

USD/JPY

Chart - Created Using FXCM Marketscope 2.0

- USD/JPY extends advance as Bank of Japan (BoJ) Governor Haruhiko Kuroda sounds less confident in achieving the 2% target for inflation; .

- May see a further advance in USD/JPY as the Relative Strength Index (RSI) pushes deeper into overbought territory, but will keep a close eye on the 87 figure for resistance on the oscillator.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd is net-short USD/JPY since November 12, with the ratio sitting at -1.41.

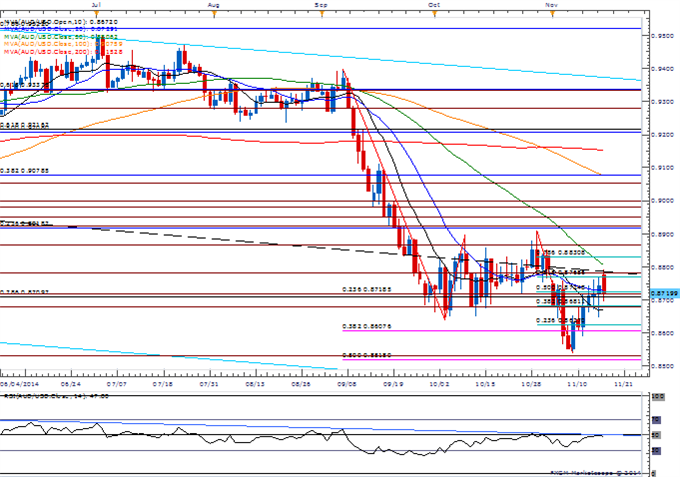

GBP/USD

- GBP/USD rebounds from a fresh monthly low (1.5588) even though the Bank of England (BoE) Minutes showed another 7-2 split as a growing number of central bank officials highlight a risk of overshooting the 2% target for inflation.

- With U.K. Retail Sales projected to rebound 0.3% in October, positive data prints should heighten the appeal of the sterling as the BoE remains on course to normalize monetary policy in 2015.

- As GBP/USD continues to hold above 1.5540 (78.6% retracement) to 1.5550 (61.8% expansion), will watch former support around 1.5890 (61.8% retracement) to 1.5900 (50% expansion) for new resistance.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Make Or Break For AUD/USD

NZDUSD Rally at Risk Sub 7975- Scalps Target Near-term Correction

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia