USDOLLAR Risks Larger Pullback on Dismal 3Q GDP Report

Talking Points:

- USDOLLAR Vulnerable to Dismal 3Q Gross Domestic Product (GDP) Report.

- USD/JPY Bullish Outlook Clouded by Fiscal, Monetary Policy Uncertainty.

- NZD/USD Remains at Risk for Further Losses Amid String of Lower-Highs.

USDOLLAR(Ticker: USDollar):

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11339.81 |

11351.1 |

11320.32 |

0.10 |

51.13% |

Chart - Created Using FXCM Marketscope 2.0

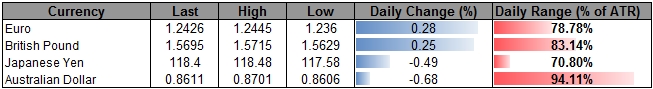

- Dow Jones-FXCM U.S. Dollar Index certainly faces a risk for a larger pullback as the preliminary 3Q Gross Domestic Product (GDP) report is expected to show a downward revision in the growth rate to an annualized 3.3% from an initial forecast of 3.5%.

- Nevertheless, we will retain a long-term bullish outlook for the USDOLLAR amid growing bets for a Fed rate hike in mid-2015; need to see faster inflation for a greater argument to normalize monetary policy sooner rather than later.

- Continued failed attempt to push & close above 11,351 (78.6% expansion) may highlight a near-term top; former resistance around 11,120 (161.8% expansion) to 11,138 (61.8% expansion) in focus going into December.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Chicago Fed National Activity Index (OCT) |

13:30 |

0.33 |

0.14 |

|

Markit Purchasing Manager Index Services (NOV P) |

14:45 |

57.3 |

56.3 |

|

Markit Purchasing Manager Index Composite (NOV P) |

14:45 |

-- |

56.1 |

|

Dallas Fed Manufacturing Activity (NOV) |

15:30 |

9.0 |

10.5 |

Click Here for the DailyFX Calendar

USD/JPY

Chart - Created Using FXCM Marketscope 2.0

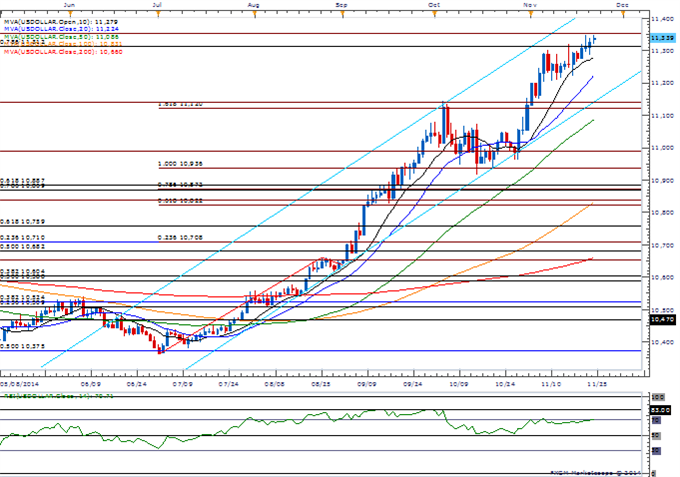

- Long-term USD/JPY outlook remains bullish as the Bank of Japan (BoJ) continues to embark on its easing cycle; will continue to favor topside targets as the Relative Strength Index (RSI) pushes deeper into overbought territory, but need a break of resistance around the 87 region to favor fresh highs.

- Snap election on December 14 may spur a material shift in the USD/JPY forecast as Democratic Party of Japan (DPJ) pledges to combat excessive Yen weakness.

- Will keep a close eye on month-end flows as the DailyFX Speculative Sentiment Index (SSI) shows retail crowd turning net-short on USD/JPY earlier this morning, with the ratio currently standing at -1.05.

For more updates, sign up for David's e-mail distribution list.

NZD/USD

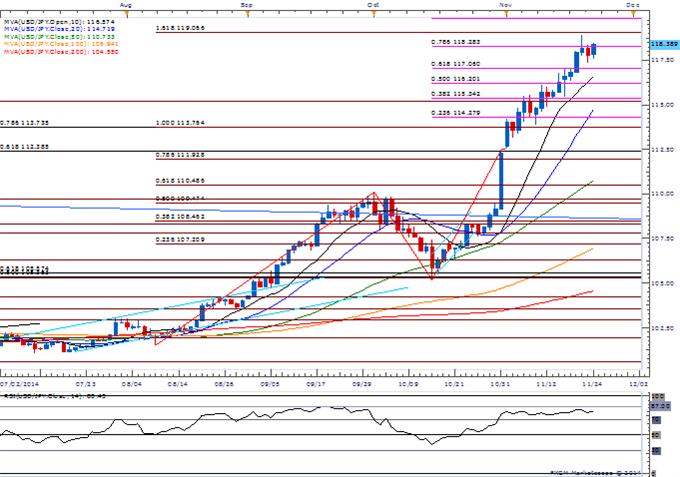

- Will continue to look for a series of lower-highs in NZD/USD as the RSI retains the bearish momentum from back in March while the Reserve Bank of New Zealand (RBNZ) preserves the verbal intervention on kiwi.

- Even though the Trade Balance is expected to show the deficit narrowing in October, seems as RBNZ Governor Graeme Wheeler is in no rush to normalize monetary policy.

- Downside targets remain favored, but need a close below 0.7830 (23.6% expansion) to 0.7850 (50% retracement) for conviction/confirmation for a lower-low.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: EUR/USD Rebounds Ahead of Yearly Low

EURUSD Slammed into Range Lows on Outside Week

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia