WTI Eyes $80 On Glut Concerns, Gold Holds Ahead Of US Event Risk

Talking Points

- Crude Oil Faces Critical Barrier As Supply Glut Concerns Linger

- Silver Eyes 16.70 As Trendline Resistance Keeps Risks Skewed Lower

- Gold Vulnerable To USD Strength Over Q4 – Quarterly Forecast

Crude oil endured another volatile session to close out the week on Friday. WTI slipped by close to 1 percent with newswires once again citing supply glut concerns as a potential catalyst. Looking to the session ahead medium-tier data is on offer from the world’s largest consumer of the commodity, the US.

Robust economics readings may offer a positive signal for the demand side of the equation. Yet lingering expectations for ample global supplies may continue to weigh on the commodity and limit the scope for a recovery.

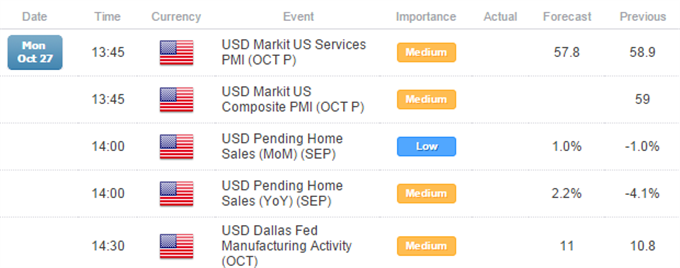

Meanwhile, the precious metals had a lackluster session despite a marginally weaker US Dollar. US Services PMI data and Pending Home Sales figures due at the outset of the week may offer the greenback some guidance. Yet it would likely take a significant negative surprise to catalyze a selloff in the USD and boost gold and silver. This is given traders may be treading cautiously ahead of the FOMC Meetingand Third Quarter GDP datalater in the week. Read the US Dollar weekly forecast and gold outlook for further insights.

ECONOMIC EVENTS

Source:DailyFX Economic Calendar, Times In GMT

Market Movements (Fri 24 Oct, 2014, Close 5PM EST)

|

Energy |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

US Oil |

81.95 |

81.95 |

80.34 |

81.24 |

(0.71) |

-0.87% |

|

UK Oil |

86.79 |

86.79 |

85.27 |

86.23 |

(0.56) |

-0.65% |

|

Natural Gas |

3.648 |

3.65 |

3.555 |

3.62 |

(0.02) |

-0.69% |

|

Metals |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

Gold |

1,231.58 |

1,234.29 |

1,228.75 |

1,230.36 |

(1.22) |

-0.10% |

|

Silver |

17.17 |

17.34 |

17.12 |

17.19 |

0.01 |

0.08% |

|

Palladium |

778.5 |

788.4 |

776.5 |

779.5 |

1.00 |

0.13% |

|

Platinum |

1,254.80 |

1,260.40 |

1,245.90 |

1,249.10 |

(5.70) |

-0.45% |

|

Copper |

3.032 |

3.058 |

3.029 |

3.037 |

0.00 |

0.16% |

CRUDE OIL TECHNICAL ANALYSIS

Crude is once again pressing against the critical 80.00 floor which has negated a Piercing Line pattern on the daily. As noted in previous reports the scope for a recovery may be limited by overhanging resistance at 84.00. Alongside a core downtrend (descending trendline, 20 SMA, ROC) a daily close below the 80.00 barrier would be required to open the 2012 low near 77.00.

Crude Oil: Awaiting Break Below Psychologically-Significant Barrier

Daily Chart - Created Using FXCM Marketscope 2.0

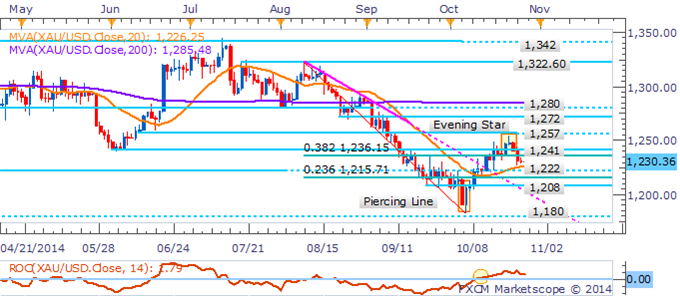

GOLD TECHNICAL ANALYSIS

Gold’s slide below the 1,241 mark has helped confirm an Evening Star formation which may warn of a deeper setback. Yet at this stage indications of a short-term uptrend remain intact (20 SMA, ROC). This leaves a greater alignment of indicators desired before suggesting a bearish bias for the precious metal.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Retreat From 1,257 Generates Warning Signal

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver remains in respect of trendline resistance and its retreat under the 17.30 floor has generated an Evening Star pattern. While typically a reversal signal from a preceding uptrend, the formation indicates the bears are unprepared to relinquish their control of the precious metal. This casts the immediate risk lower for a revisit of the 16.70 floor. Yet traders should be mindful that subdued negative momentum reflected by the ROC indicator suggests a clean descent may be difficult.

Silver: Respect of Trendline Resistance Casts Immediate Risks Lower

Daily Chart - Created Using FXCM Marketscope 2.0

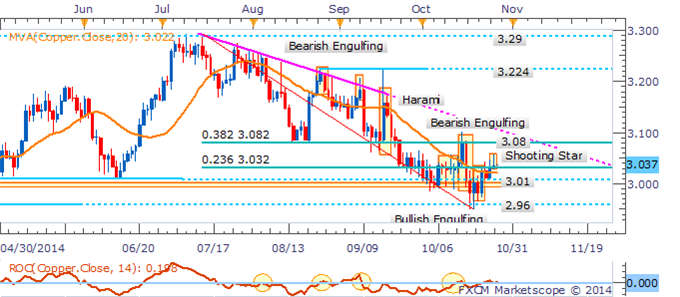

COPPER TECHNICAL ANALYSIS

Copper’s wild intraday swings have continued following a bounce from the 3.00/01 floor. Trend indicators are warning of a potential shift to positive sentiment. Yet the recent violent impulsive moves leave a clearer directional bias lacking.

Copper: Impulsive Swings Leave Clearer Signals Desired

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

Palladium’s recovery has seemingly lost some momentum as signaled by a Doji formation on the daily. A wavering around the zero bound for the Rate of Change indicator further suggests indecision from traders. Renewed upside traction is likely to see sellers return on a retest of the 38.2% Fib. near 800.

Palladium: Recovery Loses Momentum As Doji Emerges

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum continues to consolidate within the 1,242 to 1,289 range that has contained the precious metal over the past several weeks. With trend indicators swaying a breakout from the recent trading band would be desired to offer a clearer directional bias.

Platinum: Awaiting Breakout From Narrow Trading Band

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia